Umesh Modi and Vinku Shah share their expert tips on what practical steps pharmacy contractors can take to minimise their financial burden in the new tax year…

We are almost at the end of the current tax year and hopefully the Covid-19 pandemic that has plagued the world for almost two years is ending. There has been a lot of uncertainty over this period and as the current tax year ends, we look at what considerations you need to make to prepare for 2022-2023 tax year.

Corporation tax

From 01 April 2023, the corporation tax main rate applicable to non-ring-fenced profits £250,000 will increase from 19 per cent to 25 per cent. A small profits rate (SPR) will also be introduced for companies with profits of £50,000 or less so that they will continue to pay corporation tax at 19 per cent. Companies with profits between £50,000 and £250,000 will pay tax at the main rate reduced by a marginal relief providing a gradual decrease in the effective corporation tax rate.

National insurance

The government has introduced a health and social care levy of 1.25 per cent and will be added on to the Class 1 NI rate. From April 2023, the social levy will be split from the NI and shown as a separate tax. The levy will also be paid by those who are above state pension age but are still working from April 2023.

The NI lower earnings limits are also being increased but the upper earnings thresholds have been frozen which means that you will be able to keep more of the money before NI contributions kick in. This will offset some of the effects of the increase in the NI rate.

The table below shows what employees paying Class 1 NI will pay compared to 2021/2022:

Employers will pay Ni contributions at the rate of 15.05 per cent for 2022/2023 compared

to 13.8 per cent in 2021/2022.

Self-employed contractors may have to pay class 2 and class 4 contributions depending on

their level of earning as per the table below:

You may want to pay Class 3 voluntary NI contributions if there are any gaps in you NI

contributions that could affect your eligibility for state pension per the below table:

Dividend tax rate

The dividend tax rate is also set to rise from April 2022 by 1.25% across the board. The below table indicates the changes in the dividend tax rates:

Inheritance tax

There has been a reporting change on IHT which has been in effect since the beginning of the year. For anyone who passes on from 01 January 2022, there are new rules as to whether their estate can be classed as an “excepted” estate. An excepted estate is one where no inheritance tax needs to be paid.

The circumstances where an estate can be classed as an excepted estate on or after 01 January 2022 are:

- The estate has a value below the current IHT threshold (£325,000 for an individual).

- The estate is worth £650,000 or less on the death of the surviving partner and any

unused threshold is being transferred from a spouse or civil partner who died first.

- The estate is an exempt estate for example if the person who dies leaves everything to their surviving partner or a qualifying registered UK charity.

- If the deceased had been permanently living outside of the UK and their UK assets were worth less than £150,000.

Please do note that even if you are dealing with an expected estate, the administrative side of the probate will still need to be complied with.

Capital gains

From 06 April 2020, taxpayers were required to report the disposal of UK residential properties within 30 days of completion where a Capital Gain Tax Charge (CGT) arises and to pay tax due. During the Autumn 2021 budget, this deadline was extended to 60 days with effect from 27 October 2021.

The following UK tax resident persons are within scope of the 60-day CGT rule:

- Individuals

- Trustees

- Personal representatives

- Partners in a partnership and limited liability partnerships Joint owners of property.

This applies to direct interest in residential property for example, holiday homes, buy to let

properties or second homes. There would be need to report the sale in the following circumstances:

- The property has been sold at a loss

- The gain is fully covered by the available exemptions for example the annual GCT exemption or main residence relief

- The transfer is a “no gain, no loss” transfer between spouses.

The reporting should be done through HMRC's digital service. Taxpayers will need to register for a Capital Gains tax on UK property account with HMRC and choose to either report the gain themselves or appoint a tax adviser to report the transaction on their behalf.

Once submitted, a payment reference will be issued, and this should be used to make the

payment on account within the 60-day deadline.

A computation of the final CGT liability is made when preparing the taxpayer's self-assessment tax return. If the payment on account is less than the actual liability, HMRC will charge interest on the amount underpaid therefore it is crucial that you use a tax adviser for computing your CGT charge on disposal of residential properties.

It is important to keep updated on various changes in the tax regime to ensure you plan in

advance and pay the correct amount of tax and avoid any unnecessary additional costs in terms of interest and penalties.

(This article is based on current practice and is for guidance only. Specific professional advice should be taken before acting on matters mentioned here. Umesh Modi BA ACA is a Chartered Accountant and Tax Advisor, and a partner at Silver Levene LLP. He can be contacted on 020 7383 3200 or umesh.modi@silverlevene.co.uk. Vinku Shah FCCA is a Chartered Certified Accountant and Manager at Silver Levene LLP. He can be contacted on 020 7383 3200 or vinku.shah@ silverlevene.co.uk.)

Health Secretary Wes Streeting addresses Pharmacy Conference via video

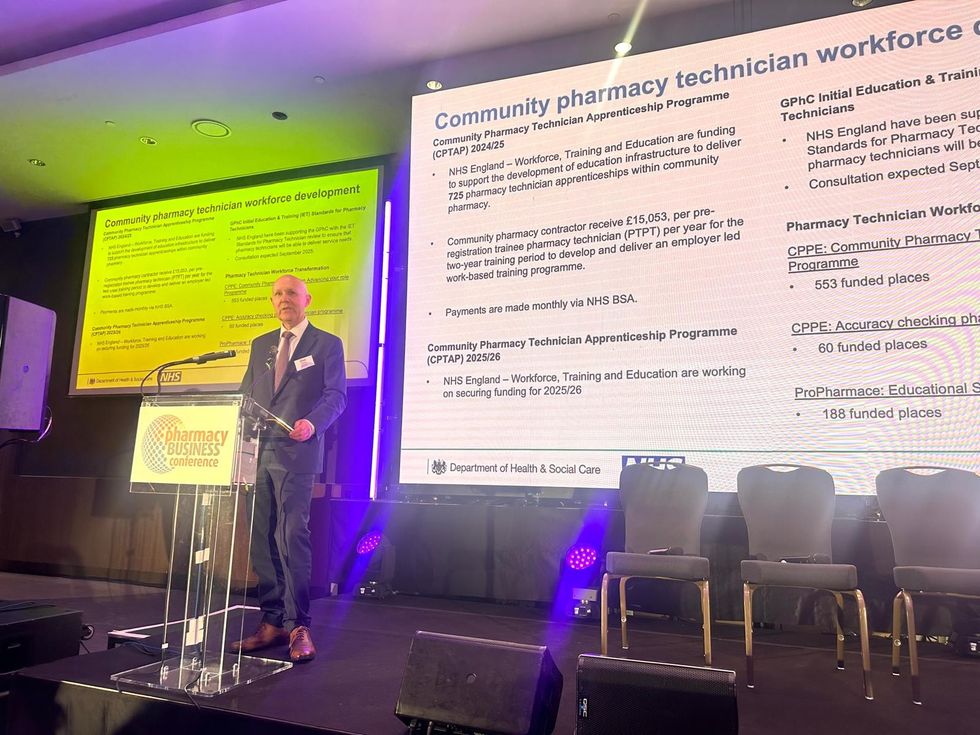

Health Secretary Wes Streeting addresses Pharmacy Conference via video  David Webb, chief pharmaceutical officer of NHS England

David Webb, chief pharmaceutical officer of NHS England Shailesh Solanki, executive editor of Pharmacy Business

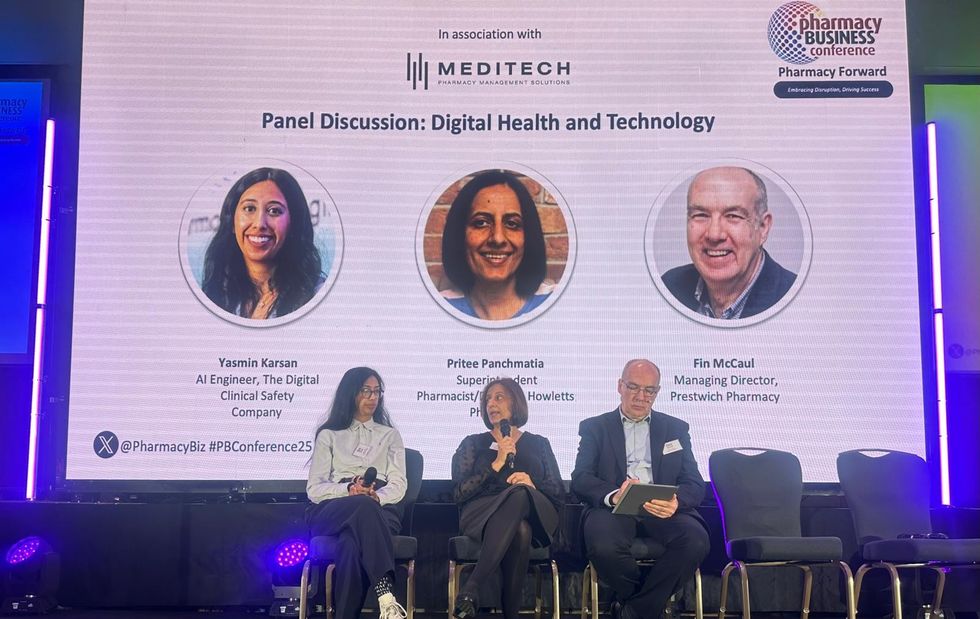

Shailesh Solanki, executive editor of Pharmacy Business L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul

L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul  L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu

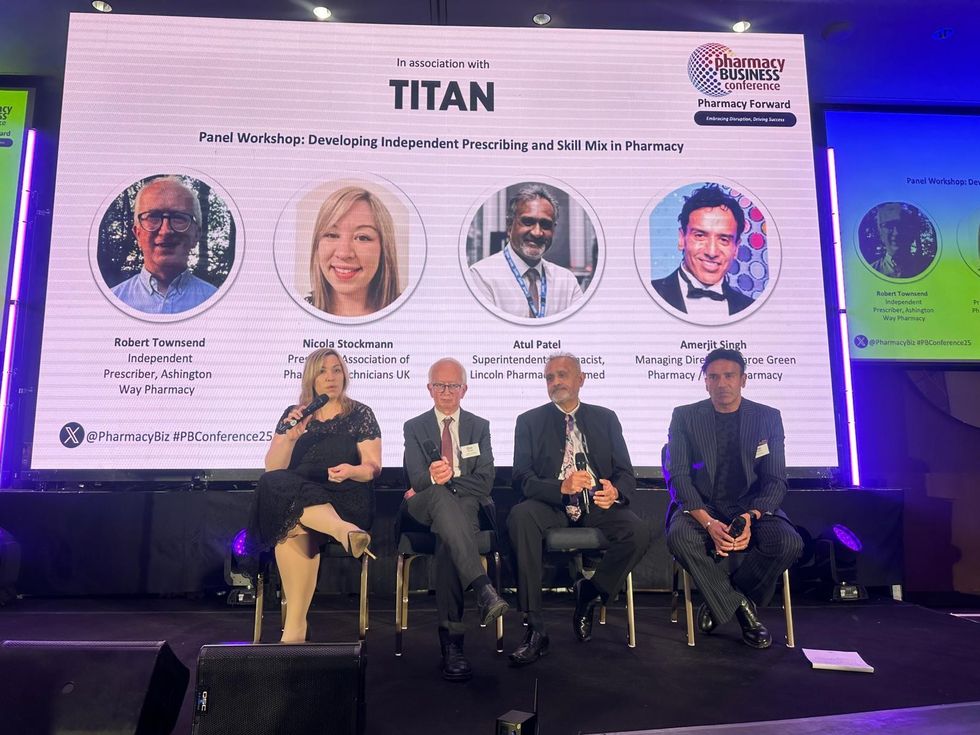

L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh

L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh Wole Ososami, lead pharmacist at Westbury Chemist

Wole Ososami, lead pharmacist at Westbury Chemist

A woman using kiosk at pharmacy store gettyimages

A woman using kiosk at pharmacy store gettyimages  Pharmacist examining commissioning machine in pharmacy gettyimages

Pharmacist examining commissioning machine in pharmacy gettyimages