Navigating health insurance can feel overwhelming, but it doesn't have to. This guide will help you understand the essentials, making your health coverage decisions easier and more informed.

Why Health Insurance Matters

Health insurance is crucial for protecting you and your family against unexpected medical expenses. With the right coverage, you can access quality care without facing financial hardship.

Types of Health Insurance Plans

Understanding the various types of health insurance plans is the first step in choosing the right one for your needs.

Employer-Sponsored Plans

Many people get their health insurance through their employer. These plans often provide comprehensive coverage at a lower cost than individual plans.

Individual and Family Plans

If your employer doesn’t offer coverage, or if you're self-employed, individual and family plans are a viable option. These plans provide flexibility but may come with higher premiums.

Government Programs

Medicare and Medicaid are government-funded programs that offer coverage to specific groups, including seniors and low-income individuals.

Key Terms You Need to Know

Health insurance jargon can be confusing. Here are some key terms to help you understand your policy better.

Premium

The premium is the amount you pay for your health insurance coverage, usually on a monthly basis.

Deductible

Your deductible is the amount you need to pay out-of-pocket before your insurance starts covering expenses.

Co-payment and Co-insurance

Co-payments are fixed fees you pay for specific services, while co-insurance is the percentage of costs you share with your insurer after meeting your deductible.

How to Choose the Right Plan

Choosing the right health insurance plan involves evaluating your needs and comparing options.

Assess Your Medical Needs

Consider your health history and any ongoing medical conditions. This will help you determine the level of coverage you need.

Compare Plans

Look at different plans and compare their premiums, deductibles, and out-of-pocket costs. Make sure to check the network of doctors and hospitals as well.

Read the Fine Print

Understanding the details of each plan, including what is covered and what is not, will help you make an informed decision.

Get Broker's Advice

If you're feeling overwhelmed by the complexities of health insurance, seeking professional help from a broker can be incredibly beneficial. Brokers are knowledgeable about the nuances of different insurance plans and can guide you toward options that are best suited to your unique needs. So, personalized life insurance broker advice can provide you with tailored recommendations based on your health history, financial situation, and coverage requirements. By leveraging their expertise, you can navigate the myriad of available options more efficiently, avoiding common pitfalls and securing a plan that offers the best value and protection for you and your family. Don't hesitate to consult a broker to gain clarity and confidence in your health insurance decisions.

Understanding the Enrollment Period

Knowing when and how to enroll in a health insurance plan is essential.

Open Enrollment

Open enrollment is the period each year when you can sign up for health insurance or make changes to your existing plan.

Special Enrollment Periods

Life events such as marriage, childbirth, or losing other health coverage can qualify you for a special enrollment period outside the usual dates.

Maximizing Your Health Insurance Benefits

Once you have your health insurance, it's important to use it effectively.

Preventive Care

Many plans offer free preventive services like vaccinations and screenings. Take advantage of these to stay healthy and catch potential issues early.

In-Network Providers

Using in-network providers will save you money, as these doctors and hospitals have agreed to lower rates with your insurer.

Keep Track of Your Medical Expenses

Organizing your medical bills and insurance statements will help you manage your healthcare expenses more effectively.

The Future of Health Insurance

Health insurance is continuously evolving, and staying informed about these changes is crucial for making the best decisions for your coverage. One of the most significant trends shaping the future of health insurance is the rise of telemedicine. Telemedicine is becoming increasingly popular, enabling patients to consult with doctors and healthcare providers remotely, adding convenience and broadening access to care, especially for those in remote or underserved areas. This not only makes healthcare more accessible but also helps reduce the strain on traditional healthcare facilities.

Policy changes at the governmental and institutional levels can also significantly impact your coverage options. It's essential to stay updated on these changes to understand how they may affect your current and future insurance plans. Technological advances are making it easier to manage your health insurance as well. From mobile apps that track your medical expenses to sophisticated platforms that simplify the claims process, technology is transforming the way we interact with health insurance.

Navigating health insurance doesn't have to be daunting. By understanding your options and making informed decisions, you can protect yourself and your family from unexpected medical expenses. If you need further guidance, consider speaking with a broker and exploring additional resources. Take control of your health coverage today and enjoy peace of mind for tomorrow.

Health Secretary Wes Streeting addresses Pharmacy Conference via video

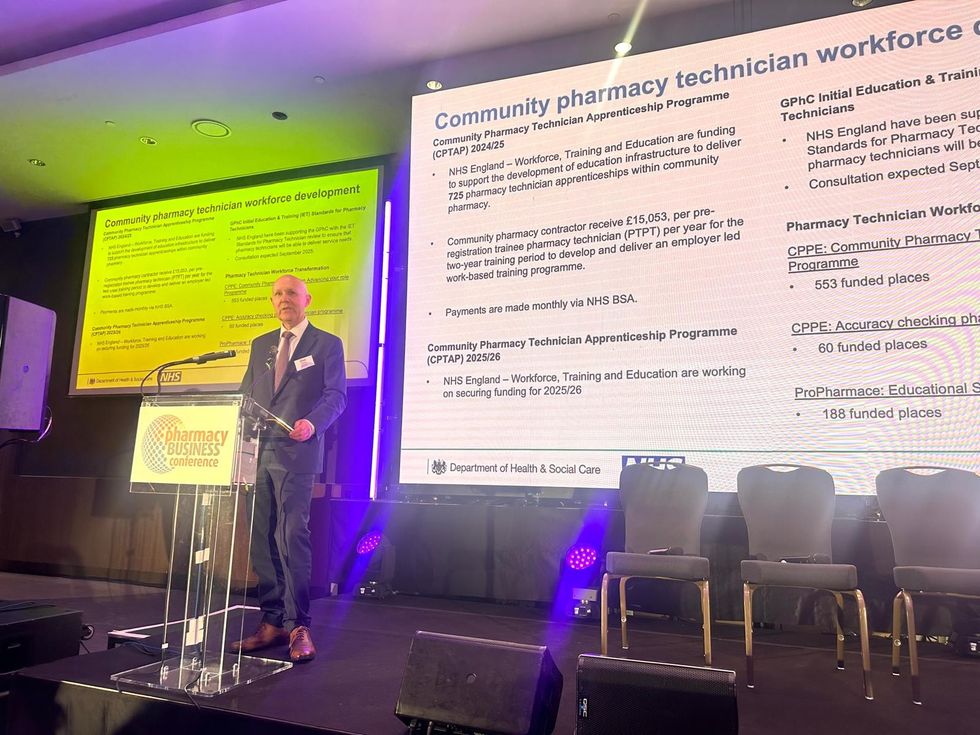

Health Secretary Wes Streeting addresses Pharmacy Conference via video  David Webb, chief pharmaceutical officer of NHS England

David Webb, chief pharmaceutical officer of NHS England Shailesh Solanki, executive editor of Pharmacy Business

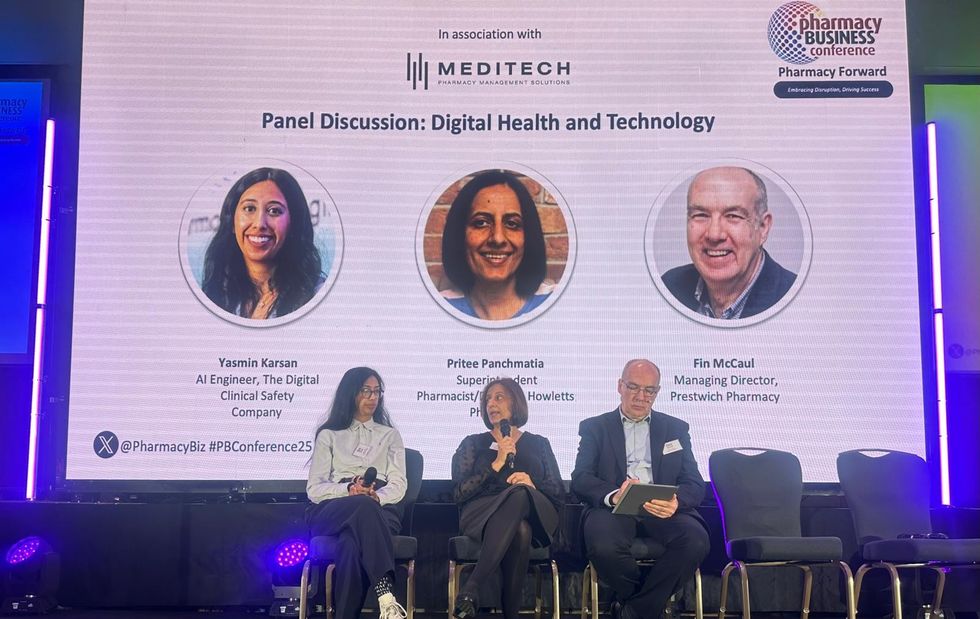

Shailesh Solanki, executive editor of Pharmacy Business L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul

L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul  L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu

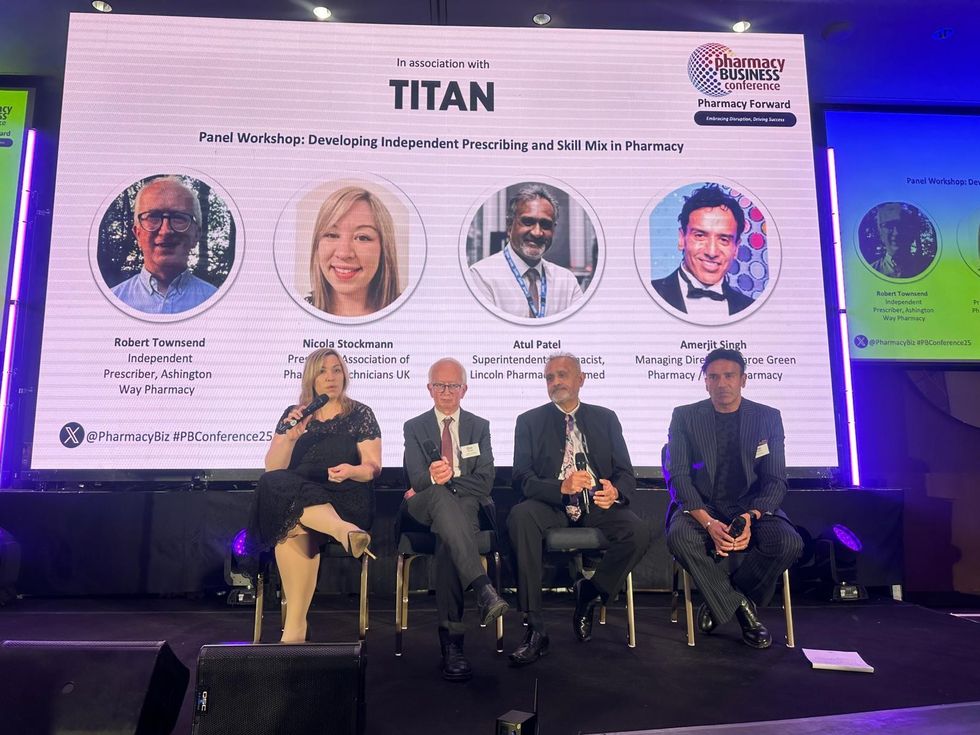

L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh

L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh Wole Ososami, lead pharmacist at Westbury Chemist

Wole Ososami, lead pharmacist at Westbury Chemist