'The UK pharmacy sector is at a crossroads, with significant trends, challenges, and developments shaping its future'

This year has been another turbulent year for the UK pharmacy sector. The sector continues to undergo significant transformations, driven by evolving healthcare needs, regulatory shifts, and economic pressures. For pharmacy owners, staying abreast of these trends is crucial to navigating the challenges and seizing opportunities. IQVIA, a leading global provider of clinical research services, commercial insights and healthcare intelligence, delves into the key issues, challenges, and developments shaping the sector, drawing insights from the latest industry data and reports, supported with data released by NHS England (NHSE).

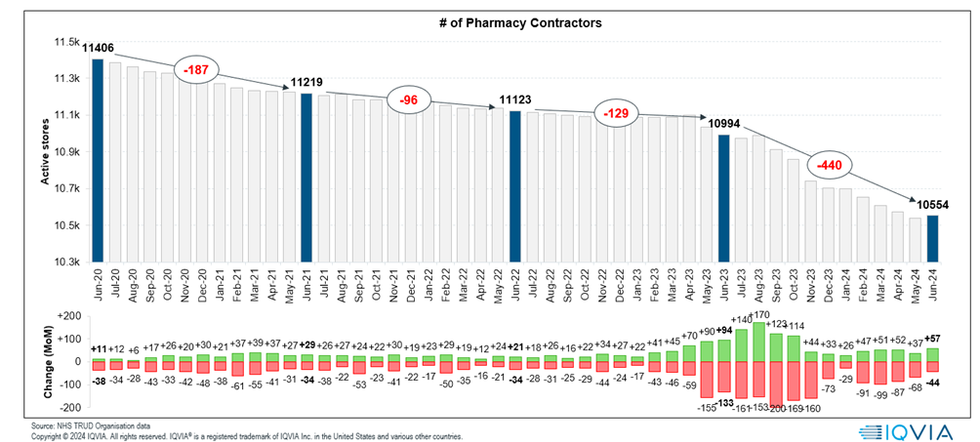

The community pharmacy landscape remains unsettled, with disruptive market dynamics at play. The decline in the number of pharmacies, particularly within the Managed Chains channel, underscores the volatility of the market. The number of active pharmacy contractors in England has dropped significantly, with more closures than openings each month, exacerbated by the exit of Lloyds Pharmacy from the UK market which completed at the end of 2023. In the year ending June 2024, there was a net closure of 440 sites within NHSE which equates to a 4% decline in available pharmacies1. The increase in closures from June 2023 was driven by the closures of Lloyds in Sainsburys and the ongoing divestment of the Boots estate.

The rise of Independents and Regional Chains

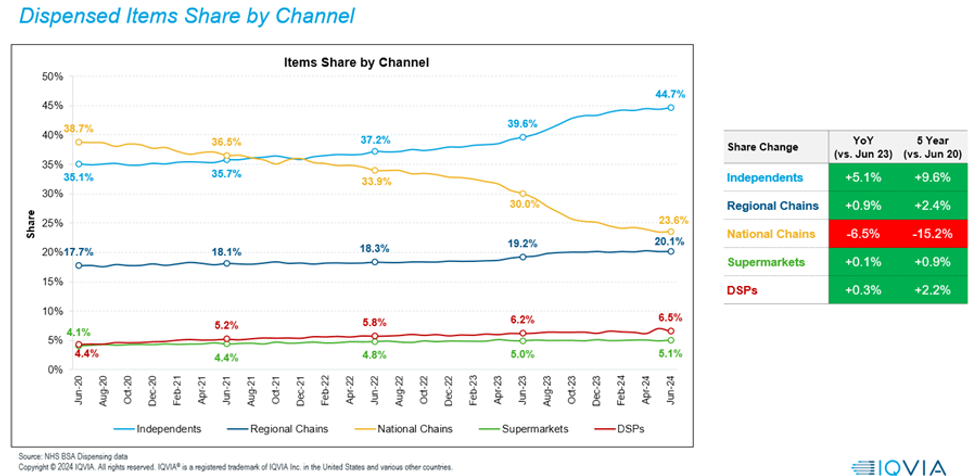

According to IQVIA data, the UK community pharmacy market experienced a value growth (at list price) of 4.9% and a volume growth of 3.5% (in terms of the number of packs) from June 2023 to June 20242. Against the backdrop of closures, increasing overheads and economic pressures means that the average pharmacy now dispenses over 8,800 items each month3. This translates to over 2,000 more items dispensed per pharmacy per month over a 4-year period. Historically, the pharmacy landscape in England was one dominated by the Managed Chains. However, at the end of 2021, an inflection point occurred where Independents overtook Managed Chains as the dominant channel, as shown in the figure below:

The Independent sector now dispenses nearly 45% of all prescriptions in England (according to NHS Business Services Authority (BSA) dispensing data4, including Regional Chains, this figure rises to almost 65%).

The growth of online pharmacies and the adoption of robotics are also reshaping the sector. The pandemic accelerated the adoption of digital solutions, with 96.6% of prescriptions now transmitted electronically. Distance Selling Pharmacies (DSPs) have seen over a 100% increase in NHS prescription dispensing activity compared to pre-pandemic levels. The merger of LloydsDirect and Pharmacy2U, which completed during 2024, means that the combined entity now dispenses over 45% of all online prescriptions in England which accounted for ~3% of all Rx in June 2024.

The NHSE data shows that over the past four years, the share of distance-selling pharmacies has increased from 4% to 7%.

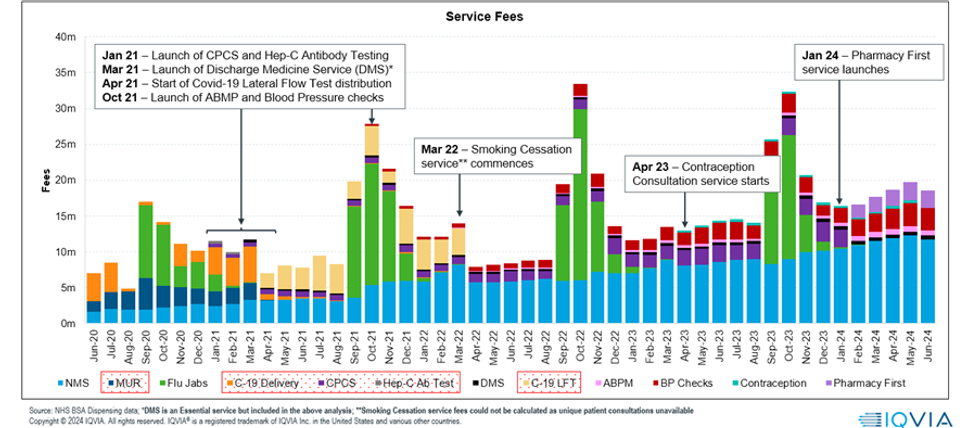

Pharmacy First

The launch of new services, including the Pharmacy First Service in England, has significantly impacted the sector. This service, part of a £645m investment into pharmacy over 2023/2024, aims to alleviate pressure on GPs and enhances the role of pharmacies in primary care by allowing pharmacies to support with minor ailments. The service commenced in January 2024 and replaced the Community Pharmacist Consultation Service (CPCS). The uptake of these services is gradually increasing, with more pharmacies enrolling and contributing to a diversified income stream. In the chart below, we can see the evolution of all Pharmacy services over the past four years:

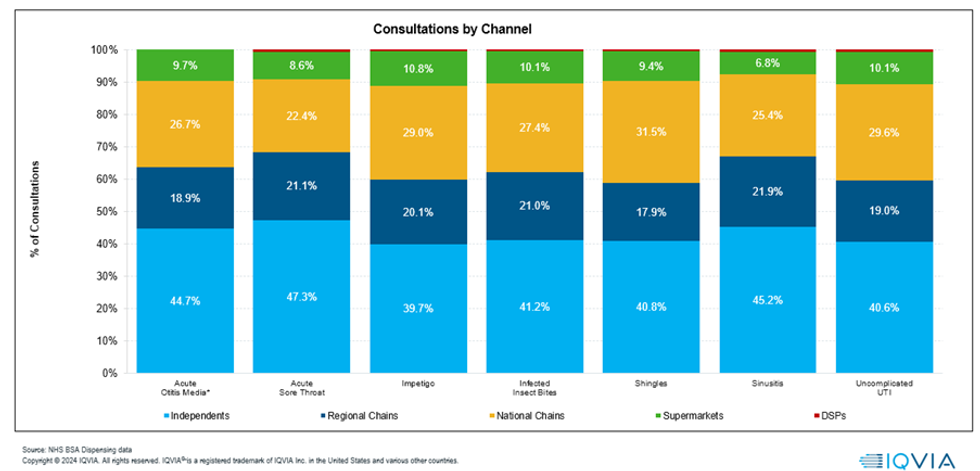

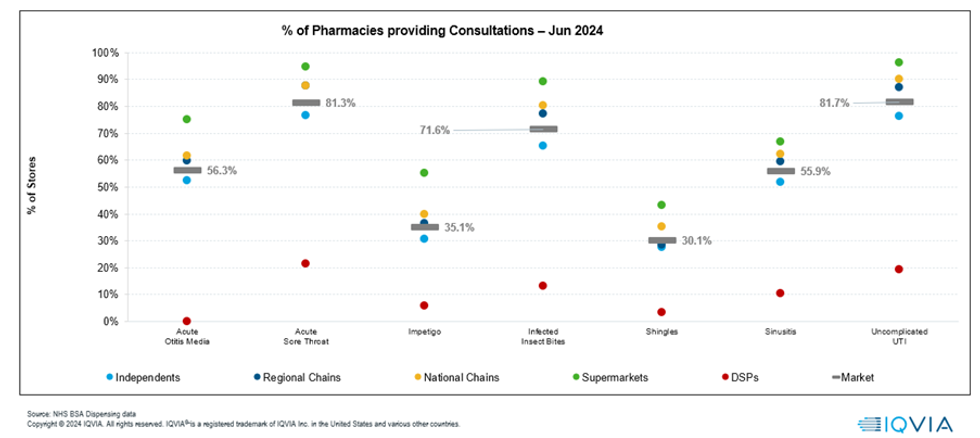

Focussing specifically on Pharmacy First, NHS BSA data shows that in June 2024, 88.3% of pharmacies were offering the new service, providing a total revenue to the sector of £11.3m since the new service started. Consultations are seasonal with infected insect bites growing through May and June, however the majority of consultations remain for acute sore throat and uncomplicated UTI with these two conditions alone accounting for nearly 58% of consultations. The data also demonstrates that over 43% of consultations are carried out by Independent pharmacies as shown on the Figure 1 below, however in Figure 2, we see that the proportion of Independents offering the services is slightly below market average with supermarkets exhibiting the highest uptake of all services.

Figure 1

Figure 2

The trial for pharmacist prescribing, which commenced in 2024, represents a major development in the sector. This initiative aims to empower pharmacists to prescribe medications, enhancing their role in primary care and providing new opportunities for service provision. The trial’s success could pave the way for widespread implementation by 2026 when all newly qualified pharmacists will be prescribers.

The UK pharmacy sector is at a crossroads, with significant trends, challenges, and developments shaping its future. For pharmacy owners, understanding these dynamics is crucial to navigating the evolving landscape. By embracing new service opportunities, adapting to regulatory changes, and leveraging digital advancements, independent pharmacies can position themselves for success in this rapidly changing environment. As the sector continues to evolve, staying informed and being proactive will be key to overcoming challenges and capitalising on opportunities. Pharmacy owners must remain agile, innovative, and resilient to thrive in the face of ongoing changes.

References:

- https://www.nhsbsa.nhs.uk/prescription-data/dispensing-data/dispensing-contractors-data

- https://images.constellation.iqvia.com/Web/IQVIA/%7B574af6e3-78f4-4264-ab55-becfb4a3f96b%7D_UK_Life_Sciences_Customer_Newsletter_September2024.pdf

- https://www.nhsbsa.nhs.uk/prescription-data/dispensing-data/dispensing-contractors-data

- https://www.nhsbsa.nhs.uk/prescription-data/dispensing-data/dispensing-contractors-data

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of clinical research services, commercial insights and healthcare intelligence to the life sciences and healthcare industries. IQVIA’s portfolio of solutions are powered by IQVIA Connected Intelligence™ to deliver actionable insights and accelerate innovations. With approximately 88,000 employees, IQVIA conducts operations in more than 100 countries. Learn more at www.iqvia.com

A woman using kiosk at pharmacy store gettyimages

A woman using kiosk at pharmacy store gettyimages  Pharmacist examining commissioning machine in pharmacy gettyimages

Pharmacist examining commissioning machine in pharmacy gettyimages

Pharmacyexprezz offers blood tests, travel vaccinations, earwax removal, cryotherapy and more.

Pharmacyexprezz offers blood tests, travel vaccinations, earwax removal, cryotherapy and more. The team at Pharmacyexprezz continues to grow

The team at Pharmacyexprezz continues to grow