RWA Pharmacy’s Adele West-Curran highlights key facts about the current state of English pharmacies while exploring future opportunities…

As COO of a business intelligence solution catering to community pharmacy in England, I look at a lot of data, from all across the country. As a result, my interpretation of the industry differs slightly from others.

Like many of you, I have read multiple articles spouting doom and gloom for this industry. While there is no denying that! In fact, I’m not sure I have ever seen such a level of empowering media attention across the industry as I have throughout 2024. Strong voices from pharmacy associations are bringing awareness to the challenges being felt by community pharmacies.

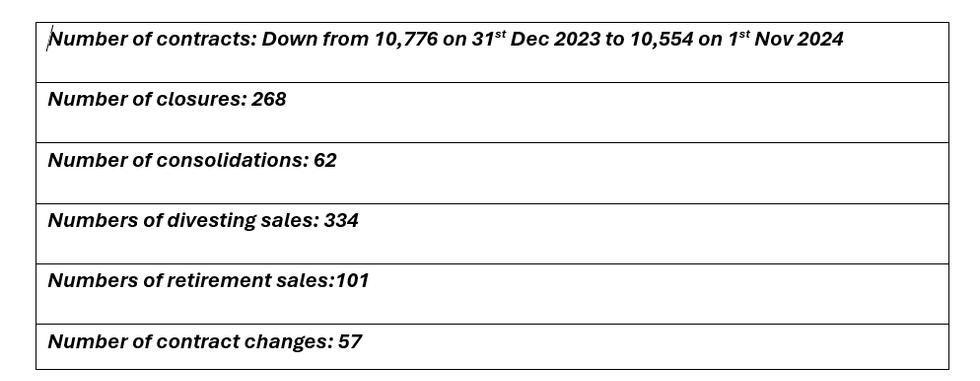

The struggle being felt by pharmacies is real, however, after another year analysing pharmacy data, I have a reason for hope. I meet with many customers who are hitting challenges head on. They’re becoming data-driven, focusing on opportunities for improvements. Many are also investing in new technologies to lighten the load of their hard-working staff. The reality though is that the need to adapt will soon no longer be a choice. There are many reasons why the need to adapt is now so strong. Here is a breakdown of some of the facts about English pharmacies in 2024 which paints the scene:

Now let’s look at each of these in a little more detail:

Lower contracts / Increased closures

A reduction in the number of contracts means pharmacies are faced with a higher volume of patients and, as a result, higher dispensing item volumes. New opportunities bring new challenges. We know dispensing margins are falling, and there is a real pressure to drive more services from pharmacy to make up the difference. Staff in pharmacies are under pressure to deliver these services, on top of dispensing medicines. Pharmacy owners and managers are faced with issues like increased wage costs on one side and burnout on the other. From the data, typically we are seeing a 3% drop in dispensing in the last 24 months. With less dispensing margin to play with, everyone is trying to do more with less.

However, if a pharmacy can identify areas where they are losing money or processes that aren’t as efficient as they could be, they may be able to creep back some of the losses being felt.

Consolidations

There have been many high-profile consolidations throughout the last few years. One that comes to mind in particular is Lloyds who sold many branches off in 2023. Some of these were then closed and merged into other existing contracts which allowed investment into one branch rather than two. This also doubled the number of patients and scripts within those pharmacies.

The good news here is that we are seeing many pharmacies react to these challenges in new and innovative ways. To offset these pressures, many of these multiples have adapted and implemented forward thinking technologies, such as hub – dispensing and robots. Not only can tools like this save time, but they can also increase efficiency, reduce errors, and help with stock management. While the investment may be high, so too is the reward.

Divesting & Retirement Sales

Outside of the whole Llyod’s sale, we have seen some significant sales of some of the larger multiples. Having access to data and insights about locality demographics, condition diversities, prescribing trends, margin vulnerabilities, and other aspects will have contributed to these decisions by the larger group owners. This will be leading to new players in the market.

New pharmacy owners are establishing businesses in a different environment than those before them. They are aware of the demands set against community pharmacies and the reality of what it takes to deliver and so approach things differently.

It is up to the NHS to support this new generation of pharmacy owners, so they thrive and successfully maintain their businesses while also delivering the highest quality of patient care. The risk of burnout and bankruptcy is a real threat facing all owners.

Contract changes

The amount of contract changes throughout 2024 has been significant. While it may be flying under the radar for now, it is an early indication that pharmacy owners can’t afford to keep their pharmacies open. Many are moving to shorter hour contracts as a way to manage overheads and wages.

Community pharmacy is vital in England. Pharmacies are providing such a varied range of services and managing patient care to a very high standard. The reality of running a profit-making business continues to be very challenging for them. However, a growing number of pharmacies are adapting well to change. They are pivoting to new technologies and systems like dispensing robots or even data analytics to ensure their businesses run as efficiently and as smoothly as possible. The amount of data and information around the pharmacy industry has never been greater, enabling data-driven decision making and consistent results. I see this playing out in real life with our customers and feel hopeful for the future.

By Adele West-Curran, Chief Operating Officer, RWA Pharmacy