Branded over-the-counter (OTC) products could play a vital role in promoting self-care and supporting the sustainability of community pharmacies, said Michelle Riddalls, CEO of PAGB – the consumer healthcare association – during the recent Pharmacy Business Conference.

Riddalls emphasised that OTC medicines not only enable consumers to better manage their health through self-care but also offer pharmacies an opportunity to increase revenue, particularly during a time of mounting financial pressure.

She referenced a 2023 Frontier Economics report commissioned by PAGB, which found that 94% of the UK population—equating to 64 million people—experience at least one self-treatable condition a year, averaging 4.2 conditions per person.

The report indicated that more than 40% have more than five self-treatable conditions a year.

Among those people with self-treatable conditions, 92%—or around 61 million people—turn to OTC products to treat those illnesses.

Furthermore, it was revealed that 983 million OTC products were sold in 2022 —equivalent to 1,870 packs purchased every minute.

This generated £3.3 billion in sales, compared to 1.37 billion prescription items dispensed dispensed across the UK that year.

“Given the higher margins that you can set on OTC products, there's definitely a lot of potential for sales in OTC medicines, which will enable consumers to further self-care within the community setting,” said Riddalls.

Market growth and consumer trends

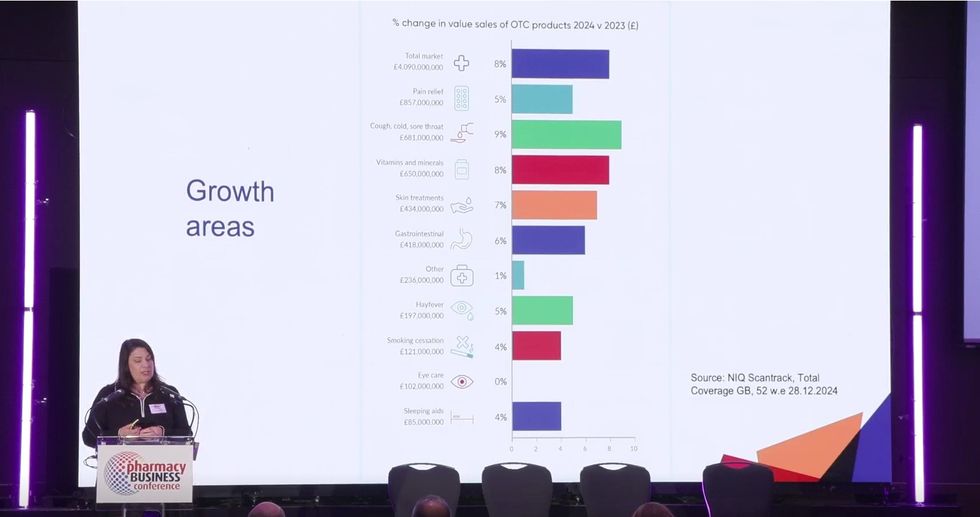

Citing NielsenIQ (NIQ) data, Riddalls noted that OTC unit sales grew by 2% between 2023 and 2024, with growth driven more by demand than price.

She explained: “The growth was a result of the general optimism at the beginning of 2024 as inflation eased and financial issues were less severe than seen in the previous year.

“This meant concern from household health outstripped the concern relating to the cost.”

Riddalls also presented data showing a rise in consumer interest in gut health, making gastrointestinal products one of the top four OTC categories with increased unit sales last year.

NIQ data also revealed a rise in sales of beauty vitamins.

“The blurring of health and beauty boundaries has allowed beauty vitamins, such as collagen supplements, to thrive as an innovation hotspot,” said Riddalls.

“This allows retailers to expand the category and generate real, sustainable volume growth.”

Insights shared at a recent Nicholas Hall conference echoed this trend, spotlighting growth in hair and beauty supplements, probiotics, sleep aids, and weight management solutions, according to Riddalls.

Another emerging area is self-diagnostics. “While this trend was especially relevant in the US, we are beginning to see it gain traction in the UK as well,” she said.

Riddalls also mentioned the potential of Dimista—a combination of azelastine and fluticasone—which is viewed as a promising treatment for moderate to severe allergic rhinitis. It is expected to be launched in the UK soon.

“Smaller retailers and pharmacies can rely on the expertise of established OTC brands to help them grow their customers' baskets, which, due to the higher margins, can increase profitability and reduce losses,” she told the conference, which was organised in London on April 6.

The total OTC market in 2024 was worth over £4 billion, a significant increase from £3.3 billion in 2022.

“So, there really is an opportunity for you to utilise the brands for both the behind-the-counter purchases and those on the pharmacy floor,” Ridalls stated.

The Power of Reclassification

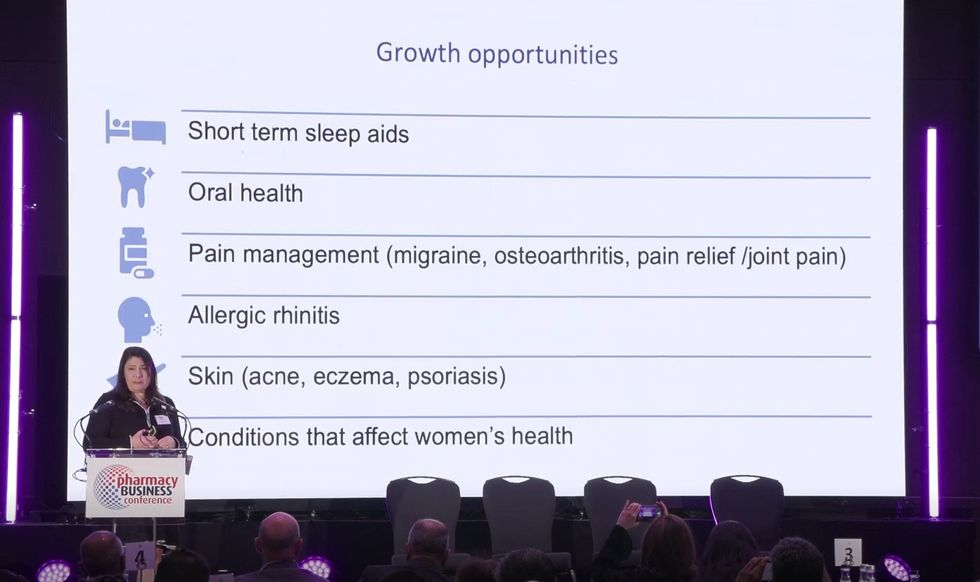

Reclassification—the switch of prescription-only medicines to OTC—represents another major opportunity for pharmacies, according to Riddalls.

In early February, the government published a list of priority therapeutic areas for reclassification,

including:

1.Short-term sleep aids

2.Oral health

3.Pain management (e.g., migraines, joint pain, osteoarthritis)

4.Allergic rhinitis

5.Skin conditions (e.g., acne, psoriasis, eczema)

6.Women's health

Riddalls said PAGB is now focused on encouraging member companies to submit applications in these categories.

While this is an opportunity for OTC manufacturers to widen their portfolios, it will also present an opportunity for pharmacies.

“With more reclassification submissions across these categories and conditions to be encouraged by the MHRA, consumer confidence in self-care could increase as patients exercise more autonomy and choice with their treatment to quickly relieve their ailments,” Riddalls explained.

“More products should start to become available for pharmacy, and therefore drive more people into your store to self-care for their self-treatable conditions.”

Riddalls added that branded OTC products help build consumer trust as they invest heavily in advertising, education campaigns, and accessible resources.

She encourages pharmacists to harness the credibility, visibility, and resources of established brands to attract more customers into their stores.