Louise Laban argues that the government’s latest impact assessment into the ‘hub and spoke’ model of dispensing suggests the cost of a hub is beyond all but the largest of pharmacies…

The second long-awaited consultation on proposed changes to UK legislation to allow all community pharmacies to access hub and spoke dispensing is underway.

Six years on from the original consultation, there remains speculation within the pharmacy market that the proposals may allow larger chains with automated hubs to charge smaller chains and independent pharmacies for “prescription assembly services” leading to an erosion of profits that cannot be recouped by any amount of patient facing services.

Unfortunately the impact assessment into hub and spoke published by the Department of Health and Social Care (DHSC), alongside the new consultation, does little to dispel this myth and suggests the cost of a hub is beyond all but the largest of pharmacies.

This in fact could not be further from the truth and had the impact assessment looked at hub and spoke models being used today by pharmacies other than what appears to be the big players they would have come to a very different conclusion.

By its own admittance the impact assessment has focussed on the large scale hubs that have been in operation for some time as well as responses and figures from the original 2016 consultation. But time and technology move on and the reality today is very different from the picture painted in the DHSC assessment.

The DHSC impact assessment claims it is only aware of six pharmacy businesses out of 3,000 across the whole sector who are using automation. We know this number is far higher and the six referred to appear to be the larger groups who have established large central hubs using multi-million pound technology.

The figure does not include other hub solutions currently available and in operation across the market today. There are early adopters out there who are already demonstrating that hub and spoke dispensing technology is an option for pharmacies of all sizes, including smaller groups with as few as three branches.

Perhaps most concerning are the figures and formulas used as a baseline throughout the assessment. We’re told in the assessment pharmacy businesses processing less than 250,000 items per week, 12m per year, may lack the scale to invest in their own hub and could instead benefit from proposals to outsource hub operations.

Such a statement shows that only one hub solution was considered as part of the assessment and it is not an accurate reflection of the market we know today. There are hubs already established that process far fewer items than 250,000 per week.

There are pharmacies who have installed automation for significantly lower volumes and who are now seeing efficiencies in terms of costs, increased staff satisfaction and the ability to provide revenue generating services without increasing staffing levels.

There are scalable solutions on the market that are available and already in use. There are, of course, lots of factors to consider, but we think a starting point for hub and spoke requires a capital investment of under £100,000 for a group of three plus pharmacies with a combined total of 45,000 items of month. Space will always be a consideration too of course but you could start your hub and spoke journey with around 10 square metres of space.

Technology can then be scaled up for larger groups. So for a group of say 18 pharmacies doing 120,000 items per month you’d be looking at a capital investment of under £500,000. This investment would provide capacity to do double the volume in a single shift. This would obviously require additional space and you would be looking at around 40 square metres as your starting point.

The assessment rightly points out that as hub pharmacies are likely to have a higher volume of dispensing, they may be able to negotiate better purchasing terms. However, it goes on to say that even where hub pharmacies do secure a better price due to their size, there is no guarantee savings will be passed on to the spoke pharmacies, and indeed, it may be the case that they could charge a slightly higher price as a way of recouping the service costs of the hub.

This is exactly why it could be advantageous to establish your own hub as a smaller group of pharmacies or independents. Outsourcing and using fewer, larger scale hubs will result in charges for independent and smaller multiple pharmacies and there is the potential that the benefits of volume buying will not be passed on to spoke pharmacies.

The more hubs the healthier the market. As the assessment says, under new legislation, hub and spoke dispensing may be possible between two or more pharmacies on a local level without any automation, with assembly or part dispensing carried out manually. I’d go one step further and suggest hub and spoke dispensing would be possible between a few higher volume pharmacies with the option to automate.

Statements that only 40 per cent of items can go through a pharmacy hub and set up costs for spoke pharmacies will cost £4,000 once again appear to have been based on large scale automated hub technology.

Affordable and scalable technology designed specifically for smaller independent pharmacies or groups of pharmacies have not been taken into account.

These smaller solutions can and do already process 70 per cent of items through the hub.

There are also hub solutions for spoke pharmacies available that cost hundreds of pounds, not thousands. In addition, cost estimates quoted in the DHSC impact assessment, that technology for dispensing hubs costs in the order of £1-2 million are not based on the technology that is available now. Hub dispensing technology is readily available for less than £100,000.

The impact assessment makes some great observations around improving patient safety and freeing up time for clinical services. However, I find it concerning the assessment has only considered the large scale hub and spoke model which requires significant investment.

Louise Laban is sales and marketing director at Centred Solutions.

Health Secretary Wes Streeting addresses Pharmacy Conference via video

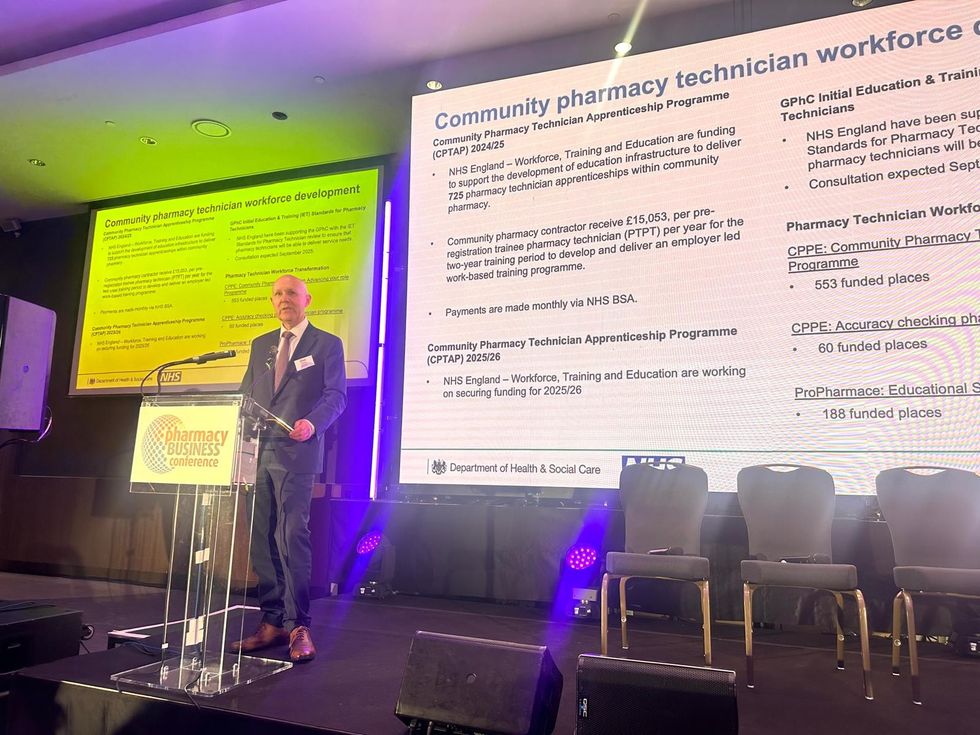

Health Secretary Wes Streeting addresses Pharmacy Conference via video  David Webb, chief pharmaceutical officer of NHS England

David Webb, chief pharmaceutical officer of NHS England Shailesh Solanki, executive editor of Pharmacy Business

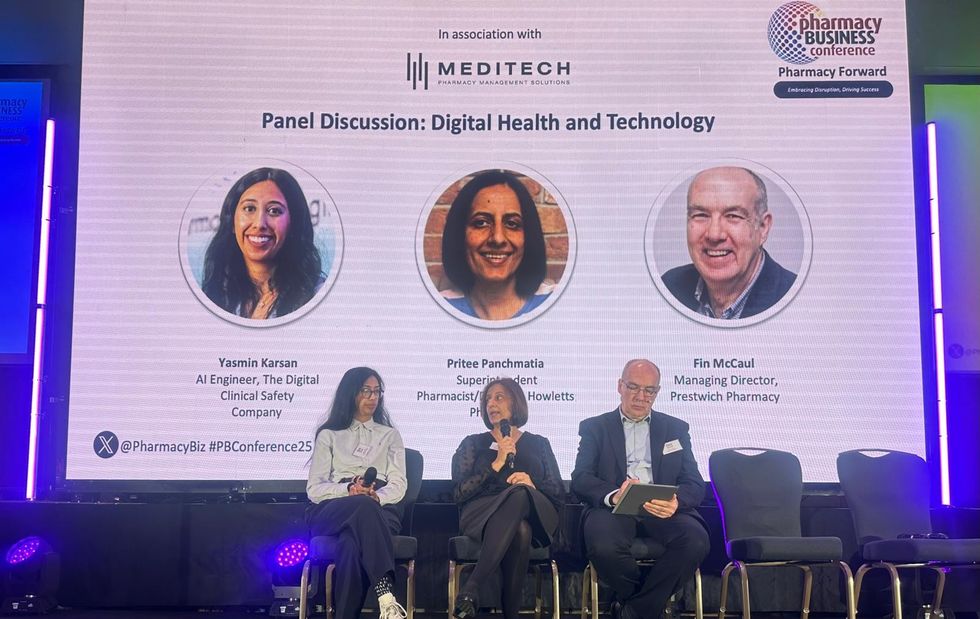

Shailesh Solanki, executive editor of Pharmacy Business L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul

L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul  L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu

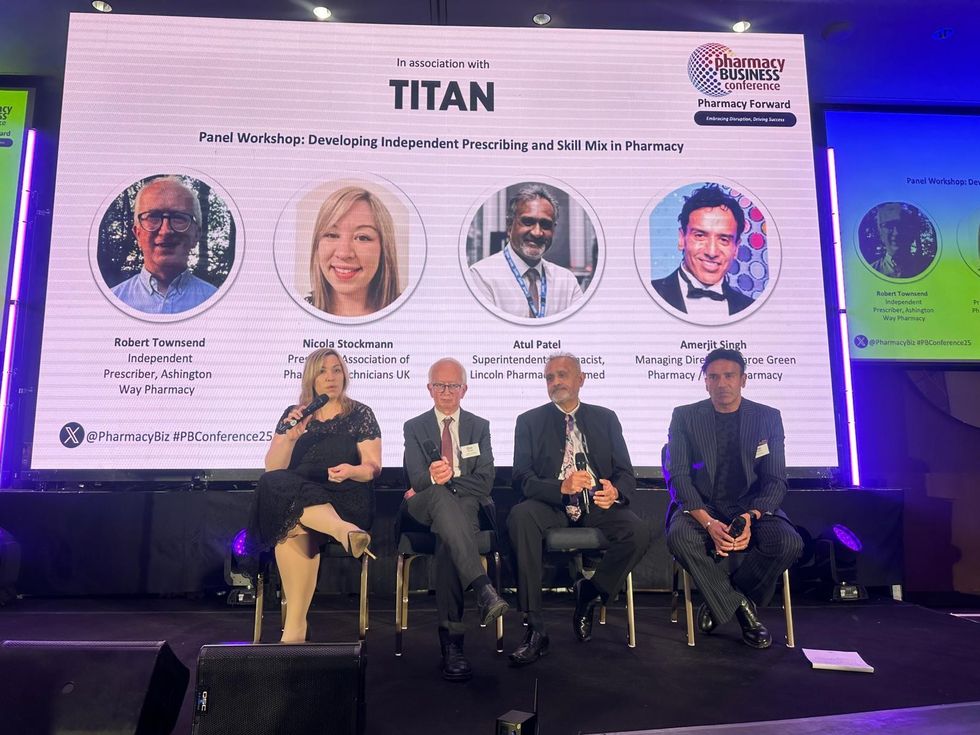

L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh

L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh Wole Ososami, lead pharmacist at Westbury Chemist

Wole Ososami, lead pharmacist at Westbury Chemist