Umesh Modi and Vinku Shah share their expert advice and list down 11 things that a potential buyer of pharmacy must consider…

We have been specializing in community pharmacy sector for over 30 years and have helped many pharmacists acquire their first pharmacy. We have seen several of those first-time buyers transition into multiple pharmacy owners under our specialist guidance and support through the years.

Acquiring the first pharmacy can be a challenge to most pharmacists especially when they do not have the necessary skill in reading the numbers presented in terms of the target pharmacy’s performance and how to interpret these in order to arrive at a valuation for the purpose of submitting an offer.

Without the guidance of a specialist accountant in community pharmacy, one of the major risks is that one could end up paying more than what the pharmacy is worth. Once the offer is accepted, there are other challenges to overcome to get the deal over the line.

1) Assessing the risk

Once the target pharmacy has been identified, you and your accountant should assess the risks and consider whether it would be a viable investment so that you are able to make an informed decision. At this point, you should gain knowledge of the target pharmacy’s operations and seek guidance on income/profit generation and growth potential.

2) Valuation of the business

Based on the information already provided by the seller’s agents, it would be advisable to obtain an independent valuation for the pharmacy so that you have a range of offer to submit. This is to ensure that you are not overpaying for the target pharmacy and bidding within sensible parameters.

3) The negotiation process

Sometimes when the initial offer is not accepted, a negotiation may take place and a pharmacy specialist accountant could provide guidance on how to go about it with a view to successfully bidding for the target pharmacy.

4) Asset or company purchase

The target pharmacy may be sold as an asset sale which usually happens when a chain is selling one of its pharmacies or it could be a company sale whereby the vendor(s) may own only one pharmacy and are selling the company’s shares (this is common when the vendor(s) are retiring pharmacists).

Each of these transactions will have their own financial and tax implications that will need to be considered at the time of acquisition and you will need sound advice in either case with a view to maximizing your tax benefit and protecting you from over-paying through inadequate due diligence.

5) Financial due diligence

This is the crux of the whole transaction, and our advice (first time buyers as well as those expanding) is not to compromise on this. We carry out a thorough and an in-depth review of the accounting records and information provided by the vendors, conduct our own independent checks to support the figures presented and liaise with our client throughout highlighting areas of concern.

One of the major risks, for example, in a company purchase is that there may be undisclosed liabilities or overstated assets and if this is not accurately verified, you could end up paying a lot more to the vendors potentially leading to long standing disputes to recover sums overpaid. Litigation could take years, is a distraction and very costly indeed. It is far better to seek professional advice from the outset from an experienced firm then to have to face a dispute after the acquisition.

6) Asset/share purchase agreement

The asset/share purchase agreement is a binding agreement between the parties encapsulating the mechanism of the sale price, payment terms, financial and tax warranties, indemnities and tax covenant etc. A pharmacy specialist accountant would review these agreements in detail, particularly to the financial and tax matters to ensure that and any risks are identified and mitigated through requesting relevant clauses be inserted/removed in the agreement.

7) Finance the purchase

The acquisition is most likely to be financed by borrowing from lenders and you would need to help of pharmacy specialist lenders that could be introduced to you by a pharmacy specialist accountant. The lenders understand the community pharmacy business and are willing to work with ambitious pharmacists/entrepreneurs and to help them grow.

Pharmacy specialist advisers considerable business with many of these lenders, we are often able to negotiate better terms for our clients. The lending fee or interest saving can sometimes more than cover the cost of their services to you. Each case is judged on the creditworthiness/security of the borrower.

8) Business plans, cashflow and profit forecasts

As part of the complete due diligence package, you will need professional assistance in drawing up the business plans, cashflow and profit forecasts which will be required by the lenders to secure the finance for the acquisition.

9) VAT/PAYE registrations

Within 4 weeks of completion date, you will require registration with the relevant authorities for all taxes for example VAT, PAYE, Self-assessment, etc.

10) On-going accounting/tax services

Post completion, it is important to agree the range of compliance services like bookkeeping, MTD compliant VAT returns, payroll, management accounts, annual accounts, corporation tax, personal tax, tax planning, financial services etc with the accountant. You should ensure they can provide a dedicated and well-trained team dealing with your all your accounting and tax requirements while you concentrate on growing your business.

11) Pharmacy specialist service providers

It is advisable to use pharmacy specialist service providers such as solicitors, lenders, stock takers, etc. as they understand the business and its requirements thereby saving valuable time and costs.

As daunting as it may sound, buying your first pharmacy need not be a complicated affair as long as you use the right professionals who may seem slightly more expensive at the outset but will save you a lot of time and cost in the long run as they will be able to deal with any complications of the transaction efficiently.

(This article is based on current practice and is for guidance only. Specific professional advice should be taken before acting on matters mentioned here. Umesh Modi BA ACA is a Chartered Accountant and Tax Advisor, and a partner at Silver Levene LLP. He can be contacted on 020 7383 3200 or umesh.modi@silverlevene.co.uk. Vinku Shah FCCA is a Chartered Certified Accountant and Manager at Silver Levene LLP. He can be contacted on 020 7383 3200 or vinku.shah@ silverlevene.co.uk.)

Health Secretary Wes Streeting addresses Pharmacy Conference via video

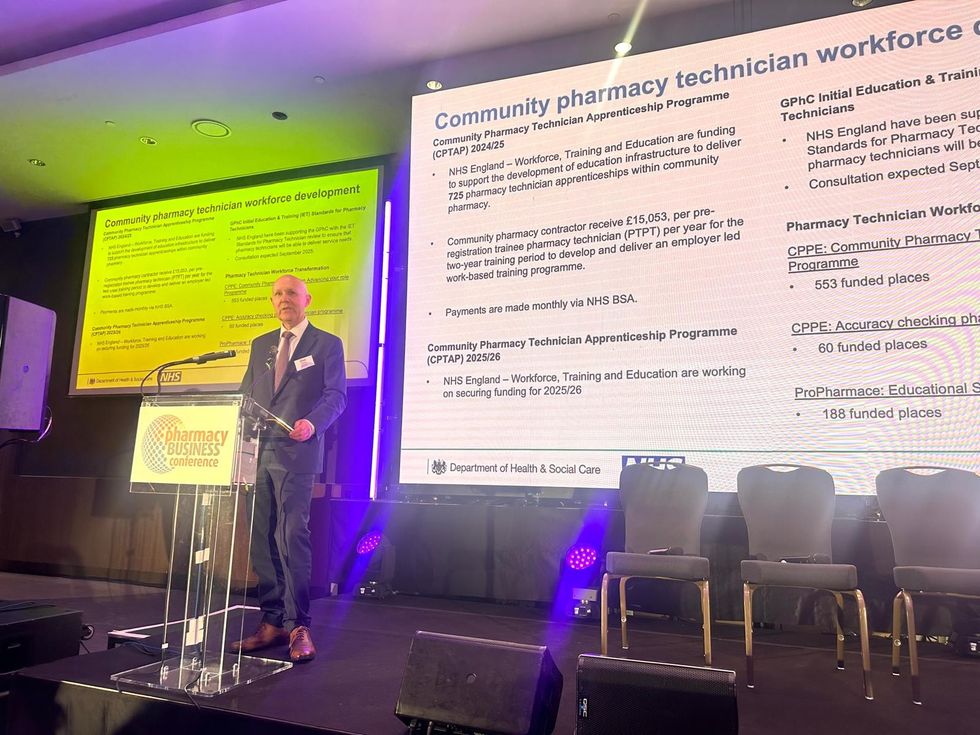

Health Secretary Wes Streeting addresses Pharmacy Conference via video  David Webb, chief pharmaceutical officer of NHS England

David Webb, chief pharmaceutical officer of NHS England Shailesh Solanki, executive editor of Pharmacy Business

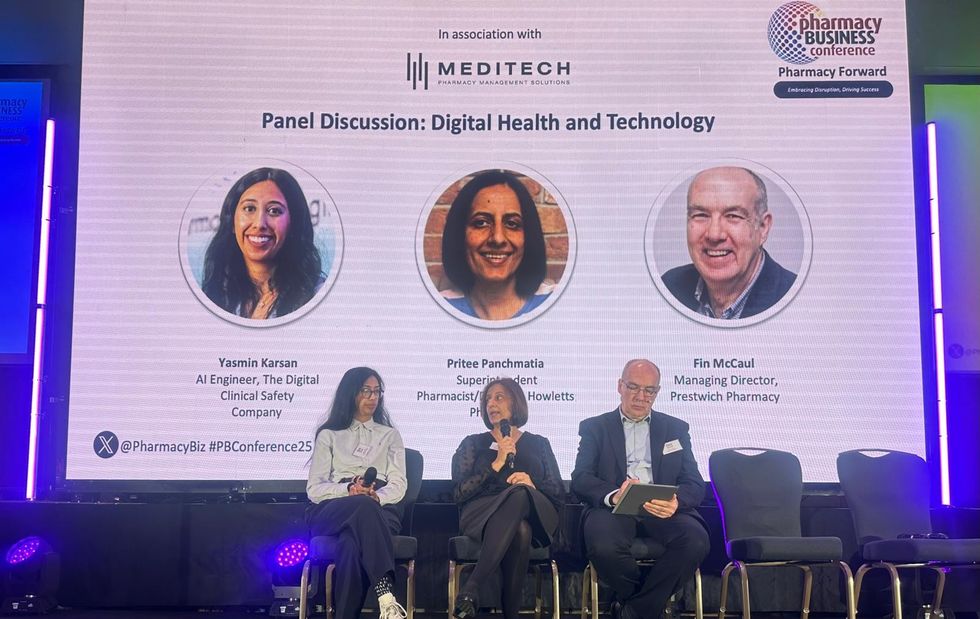

Shailesh Solanki, executive editor of Pharmacy Business L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul

L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul  L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu

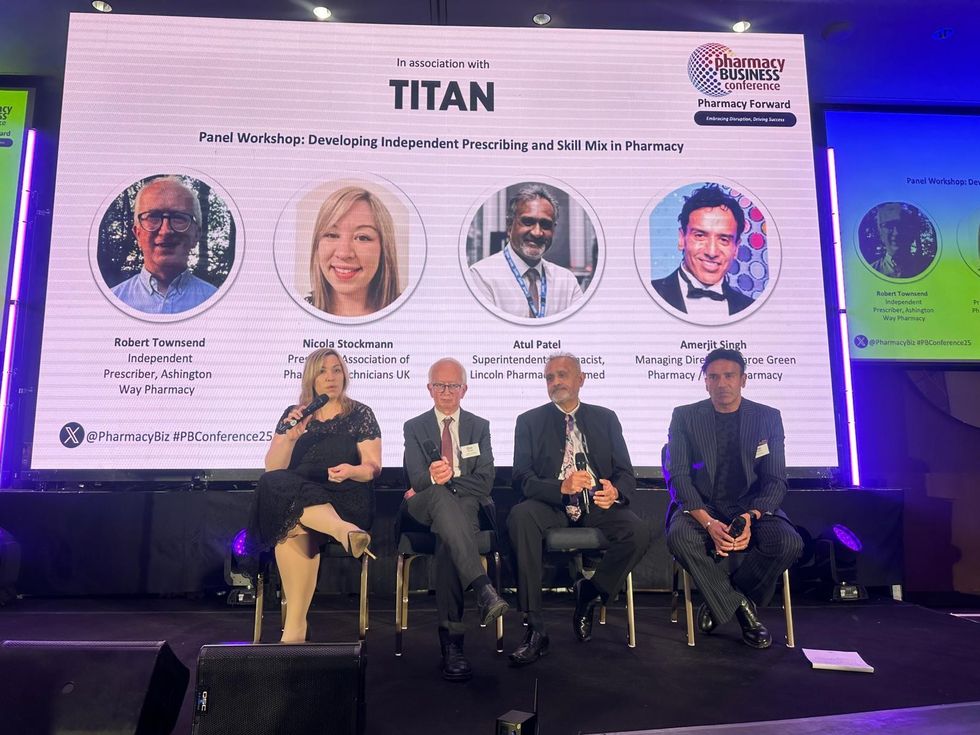

L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh

L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh Wole Ososami, lead pharmacist at Westbury Chemist

Wole Ososami, lead pharmacist at Westbury Chemist

A woman using kiosk at pharmacy store gettyimages

A woman using kiosk at pharmacy store gettyimages  Pharmacist examining commissioning machine in pharmacy gettyimages

Pharmacist examining commissioning machine in pharmacy gettyimages