The British Generic Manufacturers Association (BGMA) has called on the government to create a more supportive environment for the generics and biosimilars sector, warning that the UK risks missing out on significant NHS savings arising from new off-patent medicines.

According to the BGMA, 31 medicines are due to lose patent protection between January and June 2025, with a further 28 set to follow in the second half of the year.

The trade body estimates that the introduction of generic and biosimilar versions of these high-value medicines could save the NHS up to £150 million in the first half of 2025 alone, with total savings potentially exceeding £800 million by the end of 2029.

Currently, the use of generics and biosimilars helps the NHS save around £18 billion a year. With around 250 additional products or molecules expected to go off-patent over the next five years, the potential for further savings is substantial, BGMA noted in a report.

However, BGMA chief executive Mark Samuels stressed that these savings can only be realised if the UK remains attractive to international manufacturers.

“If a more supportive environment is not created, UK patients will have slower access to new off-patent product launches, which will result in substantial missed NHS savings as well as increased access,” Samuels told Pharmacy Business.

“Additionally, the UK will struggle to pull in sufficient volumes of medicines, which will be most visible when shortages arise, for example.”

“A stable and certain economic environment is needed,” he added.

A neglected sector

Samuels criticised successive governments for overlooking the sector in key strategies.

“Despite the NHS being reliant on their use, the generic medicines sector has been largely ignored by successive government administrations with no strategic or targeted supportive policy, including a complete absence from the last government’s Life Sciences Vision,” he said

“This must change for manufacturers to feel assured that the UK remains a place they want to continue doing business.”

The Labour government is expected to publish its new Life Sciences Plan shortly. While Samuels welcomed efforts to boost innovation and research, he stressed that equal emphasis should be given on “ensuring medicines supply resilience, particularly in times of heightened geo-political uncertainty.”

“Government support is needed to prevent the erosion of the UK's attractiveness as a priority supply destination,” he added.

Samuels welcomed progress in certain areas, such as the opening of the £520 million Life Sciences Innovative Manufacturing Fund and improvements in the MHRA’s licensing timelines.

“After falling into a situation where it was taking 2-3 years to licence a medicine, now most medicines take between 12-15 months to achieve a marketing authorisation, returning to the pre-Brexit benchmark,” he said.

“We are now hoping that the timelines will improve further, making the UK a more attractive place to supply medicines.”

UK’s global position slipping

According to Samuels, the UK has one of the most mature off-patent markets in the world, with four out of every five NHS patient prescriptions fulfilled by generic or biosimilar medicines.

“This high market penetration, underpinned by freedom of pricing and competition, means the UK has benefited from the lowest medicine prices in Europe,” he stated.

However, Samuels noted that the UK’s appeal to global manufacturers has diminished in recent years.

“The reality for the UK is that now outside the European Union, it must work harder to compete with other countries for limited global allocations of medicines,” he said.

“A range of recent issues have contributed to increasing complexity and cost, including regulatory backlogs, the uncertainty caused by the Windsor Framework agreement and the historically high government rebate rate for branded drugs, which has been improved by the renegotiated VPAG deal.”

He continued: “Off-patent manufacturers typically operate on high volumes and razor-thin profit margins and, therefore, require high levels of efficiency for supply chains which can stretch across the globe.

“Anything which adds additional costs can undermine the attractiveness of the UK as a supply market.”

Time for a policy reset

Samuels urged the government to acknowledge the importance of off-patent medicines to the NHS and build policy around maintaining supply resilience.

“Off-patent medicines are of critical importance to the UK, and the policy environment should reflect this.

“The reality is that there is very little dedicated policy focus on maintaining resilient levels of supplies of the established medicines, which are critical to the safe running of the NHS.”

Samuels highlighted that BGMA engages with government officials and ministers to ensure understanding and awareness of the importance of the off-patent sector and the challenges it faces.

The BGMA sits on the government’s Life Sciences Sector Advisory Board, NHS 10-Year Plan Council and the Life Sciences Council.

Boost for pharmacies

Community pharmacies also stand to benefit from the introduction of more off-patent medicines.

Samuels explained: “Four out of every five NHS patient prescriptions are fulfilled by generics or biosimilars, so there is a very high penetration rate of off-patent medicines already.

“This market is shaped in several ways, starting with the way GPs write prescriptions by the generic name but also, critically, the incentives in place to encourage off-patent dispensing by community pharmacists.

“Increased generic competition means lower prices for the NHS but also a more resilient market with fewer shortages. This means less time spent by pharmacies trying to secure products with supply issues and more time engaging and advising patients.”

However, he said that biosimilars are unlikely to have a major impact on community pharmacies in the short term, as they are predominantly hospital-dispensed products.

Samuels welcomed the new pharmacy funding contract, which will see community pharmacies in England receive £3.073 billion for 2025–26—an increase of £617 million.

“Pharmacies are critical for manufacturers, so the sector must be sustainable and able to thrive,” he said.

Health Secretary Wes Streeting addresses Pharmacy Conference via video

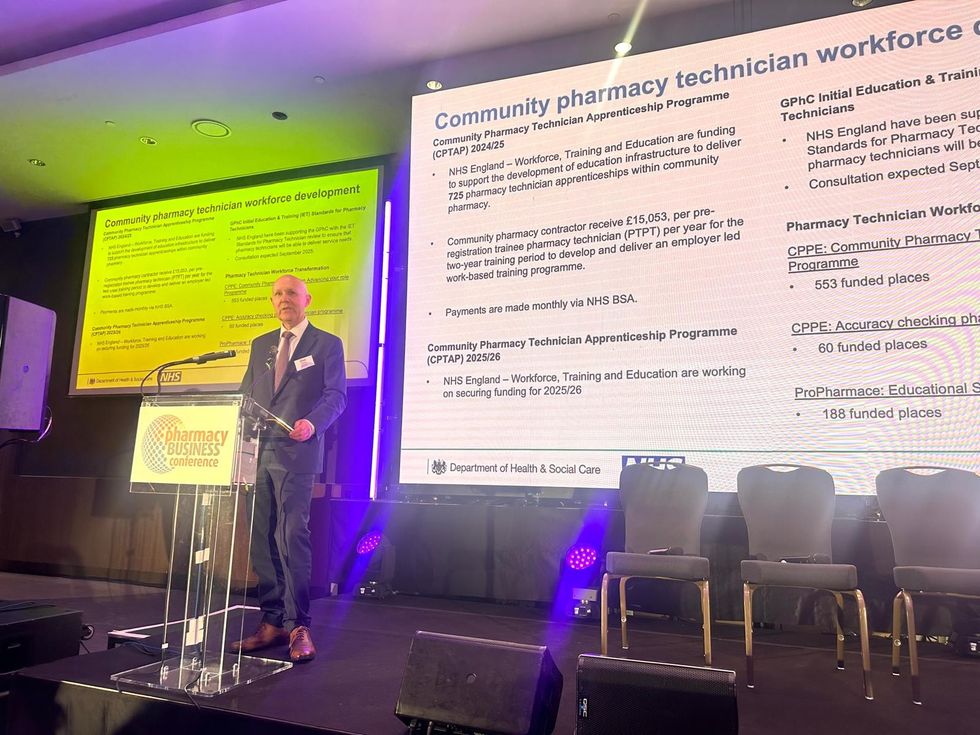

Health Secretary Wes Streeting addresses Pharmacy Conference via video  David Webb, chief pharmaceutical officer of NHS England

David Webb, chief pharmaceutical officer of NHS England Shailesh Solanki, executive editor of Pharmacy Business

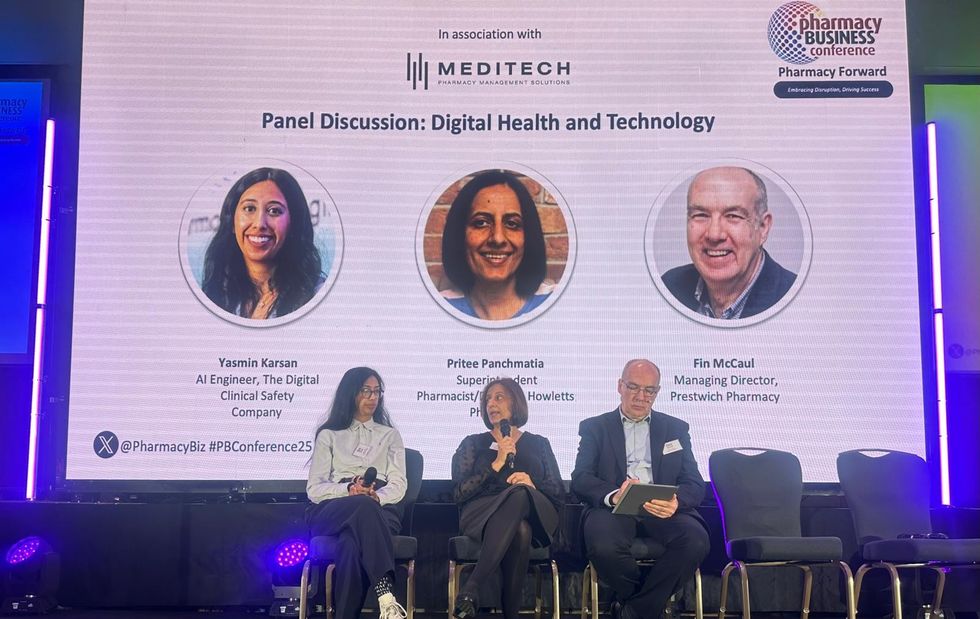

Shailesh Solanki, executive editor of Pharmacy Business L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul

L-R: Yasmin Karsan, Pritee Panchmatia and Fin McCaul  L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu

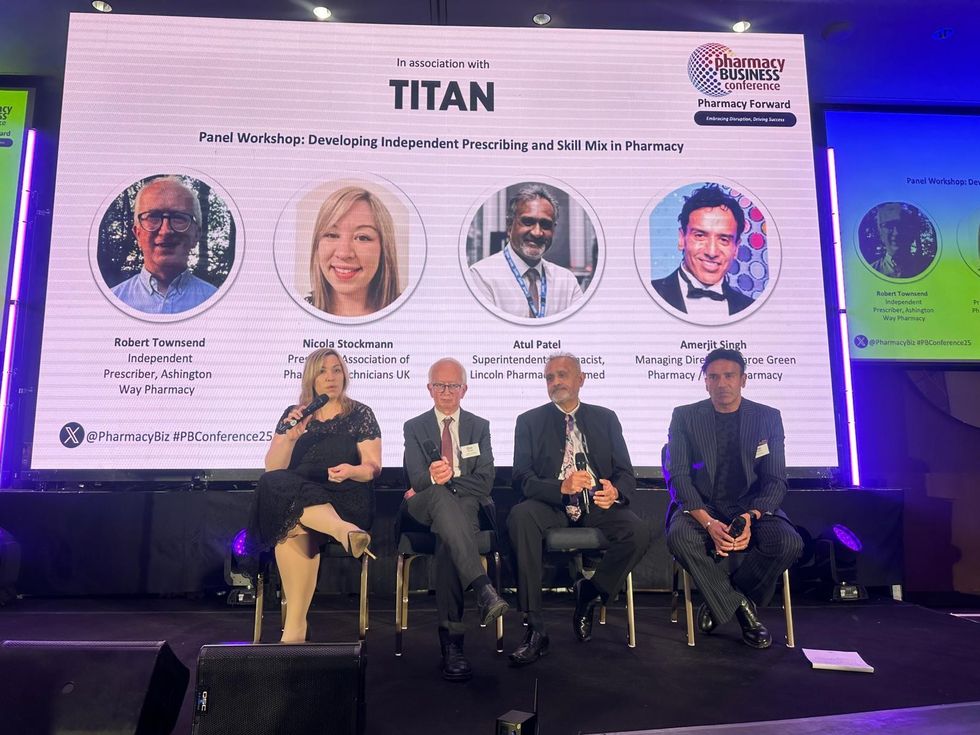

L-R: Baba Akomolafe, Rachna Chhatralia, Patricia Tigenoah-Ojo and Raj Matharu L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh

L- R: Nicola Stockmann, Robert Townsend, Atul Patel and Amerjit Singh Wole Ososami, lead pharmacist at Westbury Chemist

Wole Ososami, lead pharmacist at Westbury Chemist

A woman using kiosk at pharmacy store gettyimages

A woman using kiosk at pharmacy store gettyimages  Pharmacist examining commissioning machine in pharmacy gettyimages

Pharmacist examining commissioning machine in pharmacy gettyimages